4 June 2020

On 2 June 2020, the European Banking Authority (EBA) published a roadmap relating to the EBA’s mandates under the EU Investment Firms Directive (IFD) and Investment Firms Regulation (IFR). The roadmap includes detail on the EBA’s policy, strategy and expected timeline for deliverables under the EBA's remuneration-related mandates.

- Background

The IFD and IFR were formally published on 5 December 2019 and establish a new prudential framework for EU investment firms previously caught by the Capital Requirements Directive IV (CRD) and the Capital Requirements Regulation. The new framework contains specific remuneration requirements, which we outlined in a previous alert.

The IFD and IFR mandate the EBA, as the appropriate EU supervisory authority, to assist with the implementation of the new framework by producing additional legislation or guidance to help firms and local regulators around the EU to understand and apply the requirements. The roadmap sets out the key policy, strategy and expected timelines.

- Key remuneration points from the roadmap

The key objectives of the EBA’s strategy in the area of remuneration are to ensure there is a comprehensive framework for investment firms within the EU, taking into account their specificities and the application of proportionality, and to ensure, when possible, there is cross-sectoral consistency between the remuneration framework under the IFD and the CRD, taking into account the remuneration requirements under the Alternative Investment Fund Managers Directive and the Undertakings for Collective Investment in Transferable Securities Directive.

On 2 June 2020, the European Banking Authority (EBA) published a roadmap relating to the EBA’s mandates under the EU Investment Firms Directive (IFD) and Investment Firms Regulation (IFR). The roadmap includes detail on the EBA’s policy, strategy and expected timeline for deliverables under the EBA's remuneration-related mandates.

- Background

The IFD and IFR were formally published on 5 December 2019 and establish a new prudential framework for EU investment firms previously caught by the Capital Requirements Directive IV (CRD) and the Capital Requirements Regulation. The new framework contains specific remuneration requirements, which we outlined in a previous alert.

The IFD and IFR mandate the EBA, as the appropriate EU supervisory authority, to assist with the implementation of the new framework by producing additional legislation or guidance to help firms and local regulators around the EU to understand and apply the requirements. The roadmap sets out the key policy, strategy and expected timelines.

- Key remuneration points from the roadmap

- The key objectives of the EBA’s strategy in the area of remuneration are to ensure there is a comprehensive framework for investment firms within the EU, taking into account their specificities and the application of proportionality, and to ensure, when possible, there is cross-sectoral consistency between the remuneration framework under the IFD and the CRD, taking into account the remuneration requirements under the Alternative Investment Fund Managers Directive and the Undertakings for Collective Investment in Transferable Securities Directive.

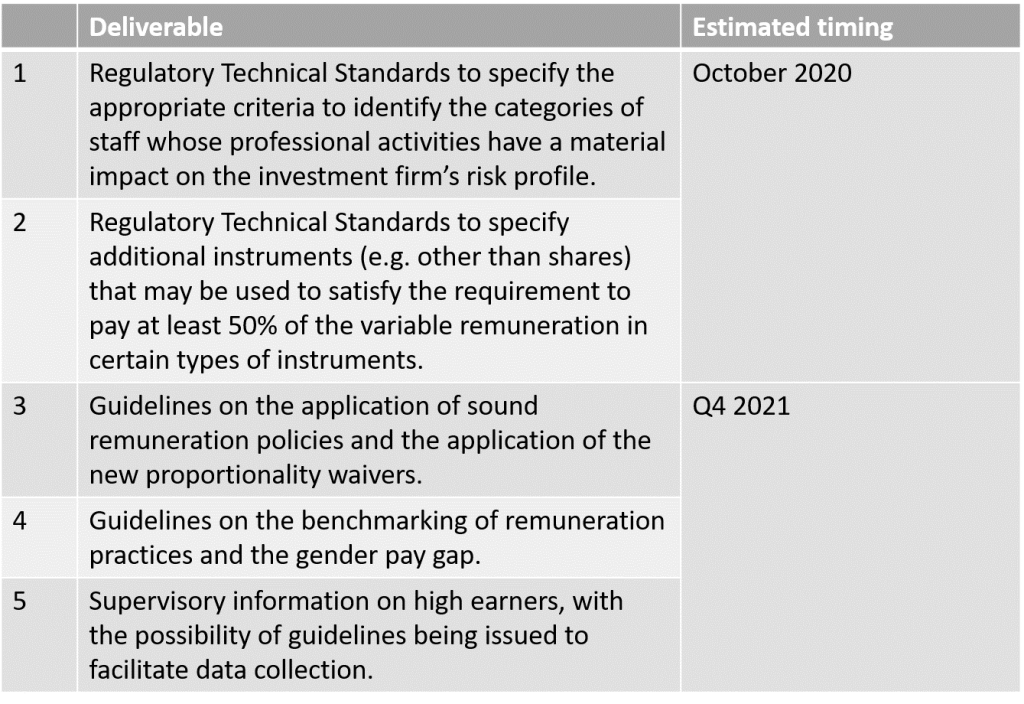

- The estimated timelines for the remuneration deliverables are as follows:

Tapestry Comment:

Firms are only required to apply the core remuneration requirements from 26 June 2021 and will likely only be required to apply the rules to remuneration payable in relation to the first performance year beginning on or after this date or a later date. Given this, and the competing priority of reacting to Covid-19, there may be a feeling within some firms that there is a lot of time available to consider the impact that the IFD and IFR may have on the firm’s remuneration structures.

For some firms, however, the IFD and IFR will have a profound impact on the firm’s remuneration structures (the key changes are outlined in our previous alert, linked above). Investment firms should prioritise focussing on the IFD and IFR changes now to understand how their remuneration structures may be impacted and what steps will need to be taken to deal with that impact, and also how any changes would be communicated to the firm’s workforce. If we can help you with this process, please do let us know. It is, however, worth noting that the impact of the IFD and IFR on UK investment firms will depend on the outcome of the ongoing EU-UK Brexit discussions and the approach that the UK decides to take in relation to the IFD and IFR. In the meantime, it is advisable that firms be prepared to apply the IFD and IFR in full.

With regard to the roadmap and the remuneration mandates outlined above, the publication of indicative timings for the deliverables is useful but it is worth noting that the EBA has not yet published any useful detail on content and each of the individual mandates will be subject to public consultations, the timing of which is currently unclear. We will issue further alerts once the content and timing of the consultation processes becomes clearer, or if we become aware of the proposed timelines being pushed back in any way.

If you would like to discuss the possible impact of the IFD / IFR on your firm’s remuneration structures, or anything else, please do contact us.

Matthew