31 May 2023

As expected, after its announcement in June 2022, HMRC (the UK tax authority) has updated the mechanism for calculating the bonus rate applicable to savings arrangements for UK tax advantaged SAYE plans (sometimes called Sharesave, or Save as you Earn).

Remind me – what is the ‘bonus rate’?

Essentially, it’s interest.

Participants in a UK SAYE plan must enter into a linked savings arrangement with an authorised savings carrier to save a specified amount per month over a 3 or 5-year period. Under the savings arrangement, the participant will potentially become entitled to a tax-free bonus - essentially this is interest which accrues on their savings, and is paid at the end of the savings period. The bonus is calculated based on a rate which is fixed at the start of the savings contract.

The “early leaver rate” is just that – it is a different (lower) bonus rate which applies where a participant leaves within the 3 or 5-year savings period (but after making 12 monthly contributions).

What will happen when the new mechanism comes into force?

The bonus rate is currently nil and has been set at this level for many years (since 2014). The bonus rate is set in accordance with an automatic mechanism which, until June 2022, was linked to market swap rates.

With effect from 18 August 2023, bonus rates will now be calculated with reference to the Bank of England base rate (the ‘Bank Rate’), which HMRC states will give greater certainty and transparency for users. However, the new mechanism will only apply to new invitations made to the SAYE after this date and not to existing savings contracts.

Provided the Bank Rate remains at 3.25% or above, it is likely that bonuses will become payable. Given that the Bank Rate is currently 4.5% (and currently showing no signs of going down in the immediate future), bonuses are likely to apply to savings contracts entered into from 18 August this year for the first time in almost a decade.

How will the new mechanism work?

The detail as to how the mechanism works and the expected bonus rates which will apply, depending on the relevant Bank Rate, can be found at: bonus rates automatic mechanism. The good news is that this document sets out the rates will which apply to SAYE savings contacts, so it is easy for companies and participants alike to see what the impact of a change in Bank Rates may mean for new contracts.

Will users of a SAYE have to work out which rates will apply?

No, HMRC will identify the correct rates to use and employers and participants can refer to these in: Change in bonus rates for Save As You Earn (SAYE) Share Option Schemes. (It is expected that HMRC will update this to include the rate which will apply from 18 August 2023 following the confirmation of the Bank Rate in early August 2023).

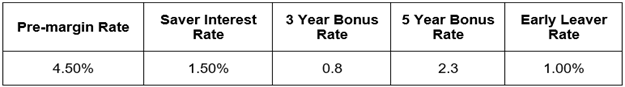

Using the information currently available in the appendix of bonus rates automatic mechanism, however, if the Bank Rate as at 18 August 2023 remains at 4.5%, the relevant rates will be as follows:

How should the bonus rates be applied?

To calculate the monetary value of the bonus to be paid at the end of the contract, the resulting bonus rate is to be multiplied by one monthly contribution. This figure is rounded to two decimal places.

For example, assuming that the Bank Rate remains at 4.5%, if an individual has a 3-year bonus contract with monthly contributions of £500.00, the bonus rate of 0.8 would be multiplied by one contribution to calculate a bonus of £400.00.

New prospectus

HMRC have issued a new prospectus (the document which governs the terms of the savings contracts), which comes into effect for savings contracts entered into from 18 August 2023 onwards. This template refers to the ‘bank rate mechanism document’ throughout, which means that the prospectus will not require to be updated to reflect any changes in the bonus rate in the future.

If bonuses do become payable, what will this mean for UK SAYE?

The obvious implication is that, going forwards, participants will normally become entitled to receive interest on their savings, in the form of a tax-free bonus whenever the Bank Rate is at or above 3.25%. Note the interest is paid by the savings carrier as a term of the savings contract – it is not an additional payment by the employer group.

However, there is another potential benefit too. Where a bonus is payable, it can also be included in the amount of the savings the participant will make over the life of the savings arrangement. This amount is called the ‘expected repayment’ and is a feature of the SAYE regime itself, so applied equally under the previous bonus mechanism.

The ‘expected repayment’ is used to calculate the number of shares subject to the SAYE option. A bigger expected repayment therefore ultimately increases the number of shares subject to an SAYE option. This means a participant can buy more shares and maximise the value they are receiving from the SAYE plan.

Tapestry comment

Existing plan participants should note, however, that the change will only apply to savings contracts entered into on or after 18 August 2023. Any change in the mechanism for calculating the bonus rates will not, of itself, impact existing contracts in any case as the rate has already been specified at nil.

A simplification of the bonus rate calculation mechanism is likely to be seen as good news, especially after a number of months of waiting to see what the new mechanism would be. The increased transparency over rates is to be welcomed – the previous mechanism linked to market swap rates was very difficult for most participants (and others) to understand. Now, the rate is clearly linked directly to the Bank Rate and HMRC has published the applicable bonus rates, so there is no need to run complex calculations.

There will be a number of things to think about in this context:

- Will a company need to amend its plan rules?

A company would not normally need to amend its UK SAYE plan rules in relation to any change in bonus rate calculation, as this is not generally set out in the rules. Again, amendments are unlikely to be needed if bonuses start becoming payable, as rules are usually drafted flexibly to accommodate payment of bonuses, in line with the legislation. However, it will depend on exactly what has been included on certain points – so specific advice should be taken. A company may also need to update its pro-forma grant minutes (e.g. to consider whether bonuses will be included in the ‘expected repayment’ to maximise the number of shares employees can buy). Now that the new bonus mechanism has been confirmed, companies may now start to consider whether any updates are necessary. - Will the employee communications need to be updated?

If bonuses become payable again, then almost certainly, yes. Given there has been no bonus payable for many years, plan communications such as brochures, FAQs and invitation documents/application forms are unlikely to cater for this adequately at the moment. Now that it is known that rates may rise above nil with effect from 18 August 2023, companies and administrators may consider turning their attention to this as soon as possible. - What if our company is due to send new SAYE invitations to employees before 18 August 2023?

Companies may consider holding off on issuing the invitations until after the new bonus regime comes into effect to ensure that these participants can benefit from any resulting bonuses. - What do companies need to do about their international SAYE arrangements?

Whilst it does depend on how the plan rules are drafted, any change in UK SAYE bonus rates may not automatically apply to an international SAYE plan. A company which wants to track its UK SAYE plan will therefore need to check its plan rules and savings paperwork for the international arrangement to see whether changes would need to be made. Legal advice would be needed – the position will be company specific.

If you have any questions, please do contact us and we would be happy to help.

Suzannah Crookes & Margaret Rankin