19 April 2023

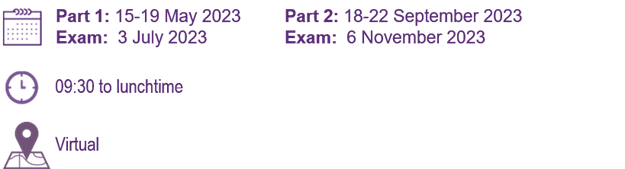

Staying ahead of the curve on regulatory and tax compliance is a never-ending task for companies. To help you keep on top of recent developments, here is our second quarterly Worldwide Wrap-Up of 2023, with some of the most recent changes that should be on your radar. We have summarised these topics briefly in this alert, however they will be covered in more detail along with other recent developments on our 26 April webinar.

China - Shanghai SAFE - updated list of ‘significant changes’

Any changes affecting a SAFE registration which are deemed to be ‘significant’ require the local company to complete an updated registration with the local SAFE office within three months. SAFE offices differ as to what counts as significant and the Shanghai office has recently announced that adding new onshore entities or removing the registered onshore entities is now deemed as a significant change.

This means that employees of the new entities cannot participate in the plan until the change application has been completed and the new entities have been included in the SAFE registration.

Changes to the SAFE registration (including the regular participants’ list update) which are not deemed as significant do not have to be reported to Shanghai SAFE upon occurrence or on a regular basis but can be registered together with the registration of a significant change.

Tapestry comment

It is a rare WWW-Up when we do not have a SAFE update or a new interpretation of the rules. This is not a major change but it is a useful reminder of the importance of keeping SAFE registrations up-to-date and being aware that any changes which might impact a SAFE registered plan, including to local entities, may have to be reported in a timely fashion.

Malaysia Salary deductions – restrictions expanded

Recent changes to the Employment Act (the Act) in Malaysia mean that the approval of the Director General of Labour (DGL) is now required for an employer to make deductions from an employee’s salary to pay contributions towards an employee share plan.

Before the amendments, the Act had limited scope and usually did not cover participants in global employee share plans. Consequently, DGL approval was generally not required for salary deductions for contributory share plans. On 1 January 2023, the Act was extended to cover all private sector employees who enter into a service contract with an employer, including participants in global share plans who would not previously have been caught by the salary deduction restrictions.

For companies offering contributory share plans in Malaysia, the choices are suddenly more restricted. It would theoretically be possible to apply to the DGL for a general exemption to cover offers made by a parent company to purchase its shares. Alternatively, the local employer can apply for permission from the DGL to take payroll deductions under a share plan offered by a parent company. A third route would be for the employee to make the contribution directly to the company once they have been paid, either by setting up a standing order or a direct debit. A more detailed analysis of the choices is included in our alert (here).

Tapestry comment

This is a surprising change and seems to go against the general trend to simplify the process for employees to participate in employee share plans. Although we can all understand the desire of regulators to protect employees from fraudulent or unscrupulous behaviour, making it more difficult for companies to include Malaysian employees in global share plans is unfortunate.

Sri Lanka - PAYE reintroduced as mandatory APIT

In November 2019, the Sri Lankan government suddenly announced that it was abolishing PAYE from 1 January 2020. Individuals were required to report and pay income tax directly. The change was intended to simplify the tax system for individuals but was met with widespread confusion.

The government quickly moved to put in place a type of voluntary PAYE, called Advance Personal Income Tax (APIT). From April 2020, employees could consent to tax withholding by their employer and the employer would pay the APIT to the Revenue on their behalf.

From 1 January 2023, this voluntary system has been made mandatory, with employers now required to withhold and pay APIT for employees.

Tapestry comment

The abolition of PAYE, caused not only confusion but was one factor in a massive drop in government revenue in 2020, just as the arrival of the Covid pandemic wrecked havoc on the country’s economy. The reintroduction of a form of PAYE is generally seen as part of an overall package of measures that will help to get Sri Lanka’s battered economy back on track.

USA - SEC adopts rules on clawback

USA - SEC adopts rules on clawback

In our last WWW-Up, we reported that the SEC had adopted final rules on clawback (here). The SEC rules require US securities exchanges to adopt listing standards that require all listed companies (including foreign issuers) to implement a compliant clawback policy. Under the timetable, US securities exchanges had until 26 February 2023 to propose listing standards that implement the final rules. The NYSE and NASDAQ proposed listing standards, which closely follow the SEC rules, were published on 13 March 2023.

The new listing standards must become effective by 28 November 2023 (although it could be earlier – such date being the effective date). Companies will then have 60 days from the effective date to comply with the new listing standards and to draft and adopt compliant clawback policies. The latest date will be 27 January 2024.

Tapestry comment

As previously discussed, companies need to review their existing clawback policies or put in place new policies. January seems like a long way off now, but an earlier effective date might mean the date for compliance is brought forward. The length of time required to complete and agree the policy should not be underestimated.

Global tax rates

We will look at some recent tax updates, in particular those countries with a tax year commencing in April. Our international advisors provide us with new rates to update OnTap as quickly as they become available. Recent announced changes include:

- Bermuda: payroll tax now applies to income up to $1,000,000.

- India: proposal to cap tax surcharge at 25% (currently up to 37%).

- Scotland: top rate of tax increased to 47%.

- Sri Lanka: after several tax changes in the past year, the maximum tax rate from 1 April is 36% for income over LKR2.5 million.

Tapestry comment

We will discuss the detail of these changes in our 26 April webinar. Countries may have made adjustments to tax bands and to social security caps. If you need specific advice for any jurisdiction, please let us know.

If you have any questions, or would like to discuss any element of legal and tax compliance for your global incentive plans, do get in touch - we would be delighted to help!

Chris Fallon, Tom Parker, Lewis Dulley

Australia - employee share scheme reforms tweaked

Australia - employee share scheme reforms tweaked Canada - trust reporting delayed - again

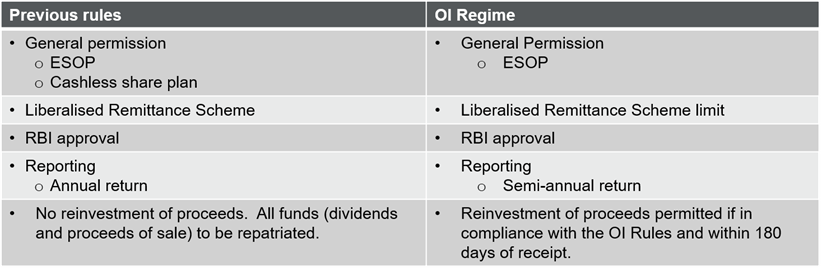

Canada - trust reporting delayed - again India - new foreign exchange rules

India - new foreign exchange rules Russia - update on the impact of counter-sanctions regime

Russia - update on the impact of counter-sanctions regime  Global tax rates

Global tax rates