13 December 2022

As of 22 August 2022, India has a new set of foreign investment rules. The new rules were issued to liberalise India’s regulatory framework and replace the existing regulations facilitating overseas investment by Indian residents. The new rules are wide ranging and this alert will focus on how the new rules affect offers to Indian employees under global employee share plans (ESOPs).

Where are the new rules?

Overseas investment in India is regulated under the Foreign Exchange Management Act 1999 (FEMA) and is implemented by the Royal Bank of India (RBI). The new rules are contained in the Foreign Exchange Management (Overseas Investment) Rules 2022, the Foreign Exchange Management (Overseas Investment) Regulations 2022 and the Foreign Exchange Management (Overseas Investment) Directions 2022 (collectively, the OI Regime).

How do the new rules apply to share plans?

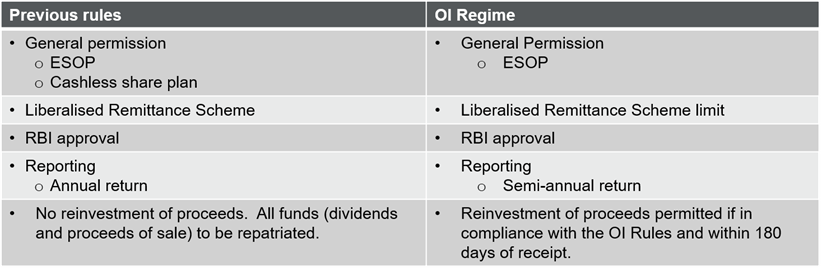

As a general rule, for Indian residents to participate in an ESOP, the individual has to obtain RBI approval or come within an exemption. This chart gives a high level overview of the key features under the old and new rules from a share plan perspective:

ESOP under the previous rules

Under the previous rules, the relevant exemptions for an ESOP were: the General Permission for offers to Indian employees and directors of a foreign entity; cashless employee share plans (i.e. plans with no outward remittances from India); and, the Liberalised Remittance Scheme (LRS). Each of these exemptions is discussed in more detail below. The local employer had to make an annual ESOP report in Annex IV to the RBI. The General Permission did not provide an exemption from the strict repatriation rules which require repatriation of the proceeds of sale of shares within 180 days and repatriation of dividends within 90 days of receipt. This meant that it was not possible to operate a DRIP (dividend reinvestment programme) for Indian employees without approval from the RBI.

ESOP under the new OI Regime

Under the OI Regime, Indian individuals who invest in foreign shares will be making either an Overseas Direct Investment (ODI) or an Overseas Portfolio Investment (OPI). In the case of a foreign ESOP, employees will usually be treated as making an OPI. The OI Regime sets out detailed descriptions of both ODIs and OPIs, but in brief (and for most ESOPs), an OPI is an investment where an individual acquires foreign securities that represent less than 10% of the foreign entity’s share capital.

General Permission: under the OI Regime, all ESOPs must come within the revised General Permission. There are no other exemptions. The main terms of the General Permission are unchanged, apart from a new semi-annual reporting obligation. To come within the General Permission, the ESOP must comply with the following:

- The individual must be an employee or a director of:

- an Indian office, or branch of the foreign entity, or

- a subsidiary in India of the foreign entity, or

- an Indian company in which the foreign entity has direct or indirect equity holding. - The shares offered under the ESOP must be offered by the foreign entity globally on a uniform (i.e., non-discriminatory) basis.

- Outward remittances must be made through an authorised bank.

- The local employer must make prescribed semi-annual filings.

Cashless ESOP: The specific exemption for cashless ESOPs has been removed. Such plans must comply with the revised General Permission and must be reported in the semi-annual filing.

Liberalised Remittance Scheme (LRS): Under the LRS, Indian residents are permitted to send up to USD250,000 offshore each year without seeking RBI consent. Subject to compliance with strict rules and reporting obligations, the LRS allows flexibility in sending funds offshore. Previously, the LRS did not mention ESOPs, and local counsel generally advised against using the LRS for an ESOP, one reason being the need to ensure that the LRS limit was not exceeded. To align the LRS with the OI Regime, the LRS has been amended to state that the acquisition of foreign shares comes under the OI Regime. Any amounts invested in foreign shares under an OPI, including under an ESOP, must come within an individual’s LRS limit.

ESOP reporting by employer: Under the old rules, employers made an annual filing on Annex IV (ESOP Reporting Statement). Under the OI Regime, this single filing is replaced with semi-annual filings on Form OPI (here). The form includes details of share plan investments held abroad and any changes (investments and sales) since the last report, as well as any amounts remitted and repatriated in the previous six months. The local employer must declare the percentage interest and the shares allotted and repurchased and the number of employees who acquired and sold shares during the period. The forms are filed by the local employer with the RBI through an authorized dealer within 60 days of each of 31 March and 30 September and late filing fees apply. As the first filing was due on 28 November this year, many companies have been caught out and local counsel advise that the filing should be made as soon as possible. Reporting companies should discuss how to complete the report with their authorised dealer.

Repatriation of funds: One advantage of the OI Regime is that it appears to permit employees in India to participate in a DRIP. The strict repatriation requirements for share proceeds will not apply so long as the funds (proceeds of sale and dividends) are reinvested under the terms of the General Permission within 180 days. If this deadline cannot be met, the funds must be repatriated to India within180 days of receipt.

Date of implementation

The OI Regime took effect on 22 August 2022. Due to the extent of the changes, local advisers have been working with the regulators to clarify the application of the changes to ESOPs. This has a caused a delay in news of the OI Regime being circulated, although, frustratingly, no delay in the implementation of the new reporting requirement.

Application of the OI Regime to previous overseas investments

Any overseas investments made prior to 22 August are deemed to have been made under the OI Regime. As a result, any plans that were offered on the basis of the previous rules or which have received RBI approval, must now comply with the OI Regime.

Tapestry comment

Foreign exchange rules in India continue to be complex. To some extent, the OI Regime appears not to have made significant changes to the operation of global employee share plans in India, but there are important updates that companies will need be aware of - in particular, the new twice yearly reporting system. Other changes are more subtle and companies will need to review their share plans to ensure that they comply with the revised General Permission. If your plan does not currently permit employees in India to participate in a DRIP, this may be something to investigate in more detail. The key takeaway is that the OI Regime is a major overhaul of the FX rules and it will take a bit of time for advisers, local teams and employees to adjust to these changes.

We would like to thank our local counsel Roshnek Dhalla at Khaitan & Co for her assistance with the information for this alert.

If you want to discuss any of the points above or want help with your share plans or other incentive arrangements, please do contact us.

Sally Blanchflower, Rebecca Perry, Sharon Thwaites