18 August 2021

The European Commission has adopted regulatory technical standards (RTS), supplementing the remuneration provisions of the Investment Firms Directive (IFD).

The RTS are as follows:

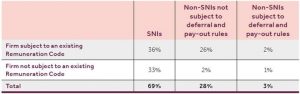

- RTS on the identification of material risk takers (MRT) - this RTS specifies the qualitative and quantitative criteria that firms subject to the IFD remuneration requirements will use to identify categories of staff whose professional activities have a material impact on the risk profile of the firm or of the assets that it manages.

- RTS on instruments used for variable remuneration - this RTS specifies the classes of instruments that adequately reflect the credit quality of a firm that is subject to the IFD remuneration requirements as a going concern and also possible alternative arrangements that are appropriate to be used for the purposes of variable remuneration.

The adopted RTS will now be reviewed by the Council of the EU and EU Parliament and, provided neither body objects, the RTS will enter into force from the fifth day following their publication in the Official Journal of the EU.

Tapestry Comment

The IFD and its counterpart regulation, the Investment Firms Regulation (IFR), introduced a new prudential regime for investment firms. The IFD had to be implemented by EU Member States by 26 June 2021 and the IFR applied directly from that date. Once these RTS take effect they will supplement the remuneration requirements set out under the IFD and IFR. Firms that are subject to the IFD and IFR should review the adopted RTS carefully and consider the impact that these may have on the firm’s remuneration structures.

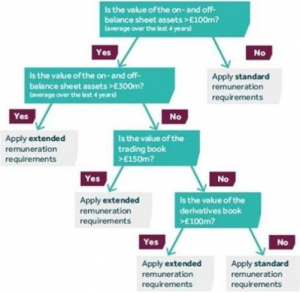

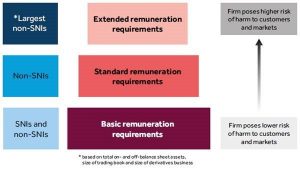

Given that the Brexit transition period has ended, these adopted RTS will not automatically apply in the UK. The UK Financial Conduct Authority’s (FCA) approach to MRT identification and the use of instruments for variable remuneration in investment firms is set out in the recently published FCA Investment Firm Prudential Regime Policy Statement.

If you have any questions on this or anything else, please do get in touch. We would be delighted to help.

Matthew Hunter and Lewis Dulley