26 April 2021

The UK Financial Conduct Authority (FCA) has published their second consultation paper on the new UK Investment Firm Prudential Regime (IFPR). This consultation paper sets out the FCA’s proposed remuneration requirements for FCA prudentially-regulated investment firms and can be accessed here. The FCA proposes that all FCA investment firms will be subject to a new remuneration code known as the ‘MIFIDPRU Remuneration Code’. The FCA is seeking feedback on this consultation by 28 May 2021.

This alert provides an overview of some of the key remuneration-related proposals set out in the consultation paper.

Background

Currently, investment firms that are authorised under the Markets in Financial Instruments Directive (MiFID) are subject to the prudential requirements set out under the Capital Requirements Regulation (CRR) and Capital Requirements Directive (CRD), alongside credit institutions. This position has attracted criticism, with investment firms arguing that the prudential rules applicable to credit institutions, including with regard to remuneration, are not properly suited to investment firms. In response, the EU published the IFD and IFR in late 2019 to establish a new prudential regime for investment firms, taking into account their level of risk and specific business requirements.

Given that the EU’s IFD and IFR only takes effect after the end of the EU-UK ‘Brexit’ transition period, the UK is not required to implement the IFD and IFR. That said, as an EU member, the UK was heavily involved in the policy discussions on creating the regime and supports the aims of the IFD and IFR. The UK proposes that the IFPR will achieve the same overall prudential outcomes as the IFD and IFR, using the IFD and IFR as a baseline but with such changes that are appropriate to account for the specifics of the UK markets, amongst other factors.

This is the second in a programme of consultation papers and policy statements that the FCA will issue to introduce the regime. The first IFPR consultation paper focussed on other aspects of the IFPR that do not relate to remuneration, although certain proposals set out in the consultation paper will impact the remuneration outcomes for firms, including the proposals relating to the categorisation of investment firms.

MIFIDPRU Remuneration Code – impacted firms and the basic, standard and extended remuneration requirements

The FCA proposes to introduce a new remuneration code for all UK investment firms authorised under MiFID, including any MiFID investment firm authorised and regulated by the FCA that is currently subject to any part of the CRR and CRD, as well as Collective Portfolio Management Investment firms (CPMIs) in relation to their MiFID business. This remuneration code will replace the existing IFPRU Remuneration Code (SYSC 19A) and BIPRU Remuneration Code (SYSC 19C), as well as related non-Handbook guidance. The new remuneration code will be called the ‘MIFIDPRU Remuneration Code’ and it is proposed that the new code will be set out at SYSC 19G of the FCA Handbook.

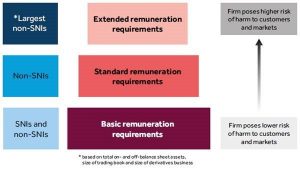

The requirements of the MIFIDPRU Remuneration Code are separated into 3 categories. The extent to which the requirements apply to a firm depends on how that firm is categorised, as well as whether certain financial thresholds are exceeded. The FCA’s first IFPR consultation paper (subject to minor amendments under the second consultation) categorises investment firms as either: (a) ‘SNIs’ – small and non-interconnected firms that meet specific criteria; or (b) ‘non-SNIs’ – firms that do not meet the SNI criteria.

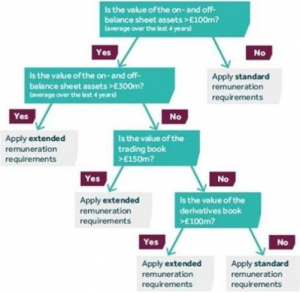

It is proposed that SNI firms will only be required to comply with a small number of remuneration rules, referred to as the ‘basic remuneration requirements’. The extent to which the MIFIDPRU Remuneration Code will apply to the remaining non-SNI firms will depend on whether certain financial thresholds have been exceeded. A non-SNI firm that does not exceed the financial thresholds will be subject to the basic remuneration requirements and additional requirements known as the ‘standard remuneration requirements’. If a non-SNI firm exceeds the financial thresholds then, in addition to the basic and standard remuneration requirements, that firm will also be subject to the rules on deferral of variable remuneration, payment in instruments, retention periods and certain rules relating to discretionary pension benefits. These additional rules are known as the ‘extended remuneration requirements’.

The financial thresholds and the impact of their application to non-SNI firms is summarised in the following flow chart provided by the FCA:

The types of rules and the impacted firms are summarised in the following overview provided by the FCA:

General

- Impacted staff – the basic remuneration requirements apply to all staff in FCA investment firms whereas the additional rules to be applied by non-SNIs are applicable only to individuals identified as material risk takers (MRTs). It is proposed that all non-SNIs identify the MRTs in relation to their firm on an annual basis, identifying all those individuals whose professional activities can have a material impact on the risk profile of the firm or the assets it manages. The FCA has proposed a broad list of categories of staff that they consider should always be deemed to be MRTs due to the responsibilities inherent in the roles, as well as related definitions and guidance. The FCA also expects firms to develop their own additional criteria, where relevant. Notably, the FCA does not propose to require firms to identify individuals based solely on the level of their remuneration as they do not view this as a reliable indicator of the level of risk involved in a role. The FCA proposes to apply the remuneration rules only to the MRTs of group entities in third country who oversee or are responsible for business activities that take place in the UK.

- Individual proportionality – the FCA proposes to continue to allow MRTs who earn below a certain amount to be exempt from the rules on deferral of variable remuneration, payment in instruments, retention periods and certain rules relating to discretionary pension benefits. The FCA proposes to base the exemption on the current exemption contained in most of its remuneration codes with a few modifications. The FCA proposes that MRTs will be exempt from the relevant requirements where they have variable remuneration: (a) of £167,000 or less; and (b) which makes up one-third or less of their total remuneration. The consultation paper also clarifies how this exemption would be applied to part-year MRTs.

- Regulatory reporting – the FCA proposes to introduce a new MIFIDPRU Remuneration Report (MIF008) to facilitate regulatory reporting and retire the existing Remuneration Benchmarking Information Report (REP004) and High Earners Report (REP005). The remuneration regulatory reporting requirements that apply to a firm will depend on whether the firm is subject to the basic, standard or extended remuneration requirements, with SNI firms needing to report the least detailed information and non-SNI firms subject to the extended remuneration requirements needing to report the most detailed information. The FCA has also published proposed reporting templates and are consulting on draft instructions for completing the templates. It is proposed that the new report be submitted annually within 4 months of a firm’s accounting reference date. The FCA does not propose to require firms to report on diversity-related pay gaps but they will consider the potential use of reporting on diversity-related data as part of their broader work on diversity and inclusion later this year. The FCA intends to consult on the public disclosure of remuneration information in the third IFPR consultation paper that they intend to publish in Q3 2021.

- CPMIs – it is proposed that the MIFIDPRU Remuneration Code will apply to the MiFID business of CPMIs. This means that CPMIs will need to apply 2 different remuneration codes, as their non-MiFID business will already be subject to the FCA’s AIFM or UCITS Remuneration Codes. Where an MRT of a CPMI has responsibilities for just MiFID or just non-MiFID business, the firm should apply the relevant remuneration code. Where an MRT has responsibilities for both MiFID and non-MiFID business, it is proposed that the firm must apply the most stringent of the applicable remuneration requirements to the individual.

- EBA guidelines – the final EBA guidelines on sound remuneration polices under the IFD will not apply to firms.

Basic remuneration requirements – applies to all FCA investment firms

The ‘basic remuneration requirements’ that apply to all FCA investment firms and in relation to all staff are summarised here:

- Remuneration policy – it is proposed that firms would need to have a remuneration policy for all staff covering all components of remuneration covered in the MIFIDPRU Remuneration Code. The proposals set out the key principles that apply to the firm’s remuneration policy. This includes a new requirement for a firm’s remuneration policies and practices to be gender neutral, although the FCA notes that, as this requirement is an equal pay requirement (as is already covered by the Equality Act 2010), it does not anticipate that this requirement would impose any additional burden on firms. There is also a requirement for firms to ensure that the remuneration policies and practices are in line with the business strategy, objectives and long-term interests of the firm. Proposed guidance clarifies that this should include, amongst other things, consideration of the firm’s risk appetite and strategy, including environmental, social and governance risk factors.

- Governance – the proposals set out the key principles relating to the governance and oversight of remuneration, including in relation to the remuneration of control functions. The FCA intends to review and amend the ‘Remuneration Policy Statements templates’ on their website that firms may use to record how their remuneration policies and practices comply with the applicable rules to align them with the final MIFIDPRU Remuneration Code.

- Fixed and variable remuneration – the proposals require all firms to have remuneration policies which make a clear distinction between fixed and variable remuneration, providing comments on the composition of, and allocation between, the 2 components. It is proposed that all firms would need to ensure that the fixed and variable components of remuneration are appropriately balanced, with the FCA providing comments on what that means and requiring that firms be able to explain why it considers a particular split of fixed and variable remuneration to be appropriate. The proposals are supported by proposed guidance, including proposed guidance concerning co-investment and carried interest arrangements. Payments made under carried interest arrangements represent a share in the profits of a fund managed by the firm’s staff. They are received by the firm for the benefit of the relevant staff as compensation for the management of the fund. In the FCA’s view, these payments should be considered as remuneration. Returns made by staff on co-investment arrangements that constitute shares in the profits as a pro rata return on an investment will not usually be considered to be remuneration but where the investment made by the individual was made in the form of a loan from the firm, and not from the individual’s own funds, the FCA would expect the returns to be categorised as remuneration.

- Financial and non-financial criteria – the proposals require that all firms take into account both financial and non-financial criteria when assessing the individual performance of their staff and sets out guidance on the FCA’s expectations to help firms to identify and apply appropriate non-financial criteria, including examples of non-financial criteria such as achieving targets relating to environmental, governance and social factors and/or diversity and inclusion.

- Restrictions on variable remuneration – the proposals require that variable remuneration must not be awarded, paid out or allowed to vest if it would affect the ability of a firm to ensure a sound capital base. The proposals also impose some restrictions on variable remuneration within firms that benefit from extraordinary public financial support.

Standard remuneration requirements – applies to all non-SNI firms

The ‘standard remuneration requirements’ that apply to all non-SNI firms are summarised here:

- Setting a ratio between variable and fixed remuneration – the FCA notes that they do not consider it to be appropriate to set a single maximum ratio between variable and fixed remuneration (a ‘bonus cap’). Instead, it is proposed that firms should set their own ‘appropriate’ ratios as part of their remuneration policies. The consultation paper sets out some high-level guidance in relation to this requirement.

- Performance assessment – the proposals state that firms should ensure that the total performance-related variable remuneration of an MRT is based on a combination of: the assessment of the performance of the individual, of the relevant business unit and the firm overall. The performance assessment must also be based on a multi-year period that takes into account the business cycle of the firm and its risks.

- Ex-ante risk adjustment – it is proposed that, when measuring performance to calculate pools of variable remuneration, firms must take into account all types of current and future risks as well as the cost of capital and liquidity required. It is also proposed that firms must ensure that the firm’s total variable remuneration is generally considerably contracted, including through malus or clawback arrangements, where the financial performance of the firm is subdued or negative. The variable remuneration awarded and allocated within the firm should also consider all types of current and future risks, including financial risks and non-financial risks. The FCA expects that a firm would be able to provide them with details of all adjustments made, including clear explanations of how they have been quantified or discretion exercise.

- Ex-post risk adjustment (including malus and clawback) – it is proposed that firms would be required to implement ex-post risk adjustment mechanisms into their remuneration policies to enable the adjusting of an individual’s variable remuneration to take account of a specific crystallised risk or adverse performance outcome, including those relating to misconduct. The ex-post risk adjustment mechanisms must at least include in-year adjustments, malus (where variable remuneration is deferred) and clawback, enabling an MRT’s variable remuneration to be reduced by up to 100%. It is proposed that firms must set malus and clawback periods that, at the minimum, ensure that malus can be applied until the award has vested in its entirety and ensure that the clawback period spans at least the combined length of the deferral and retention periods (where they exist). The proposals also set out minimum trigger events in which malus and/or clawback must be applied, although the FCA proposes that it is for a firm to determine the appropriate (additional) malus and clawback triggers for the firm. It is also proposed that the MIFIDPRU Remuneration Code will be supplemented by the FCA’s ‘General guidance on the application of ex post risk adjustment to variable remuneration’, the scope of which is proposed to be extended from only applying to the FCA’s Dual-regulated firms Remuneration Code (SYSC 19D) to also apply to FCA investment firms. The content of the guidance, which is set out at Appendix 2 of the consultation paper, would otherwise be unchanged.

- Non-performance related variable remuneration – in addition to specific comments on each, as set out below, the proposals state that a firm must ensure that all guaranteed variable remuneration, retention awards, severance pay and buy-out awards are subject to malus and clawback and, where the rules apply, the rules on deferral, payment in instruments and retention.

- Guaranteed variable remuneration (e.g. ‘sign-on bonus’ / ‘lost opportunity award’) – it is proposed that guaranteed variable remuneration must be awarded to MRTs only if: (a) it occurs in the context of hiring a new MRT; (b) it is limited to the first year of service; and (c) the firm has a strong capital base. The related guidance clarifies that the FCA expects that guaranteed variable remuneration will only be awarded rarely and not as common practice.

- Retention awards – the FCA proposes that retention awards to MRTs should only be awarded rarely and not as common practice. The FCA proposes that retention awards must only be paid to MRTs: (a) after a defined event; or (b) at a specified point in time.

- Buy-out awards – the FCA proposes that firms must ensure that any buy‑out award: (a) is aligned with the long‑term interests of the firm; and (b) remains subject to the same pay‑out terms required by the previous employer, for example by following the same deferral and vesting schedule, and being subject to the same ex post risk adjustment arrangements (malus and/or clawback), where relevant.

- Severance pay – the FCA proposes that: (a) the ability to make severance payments, and any maximum amount or criteria for determining the amount, must be set out in the firm’s remuneration policy; and (b) all payments to MRTs relating to the early termination of an employment contract reflect the individual’s performance over time and do not reward failure or misconduct.

- Annual review of remuneration policy by control functions – it is proposed that a firm should ensure that the design, implementation and effects of its remuneration policy are subject to an independent, internal review by staff engaged in control functions at least annually. The review should be conducted by the internal audit function, where one exists. The FCA would expect the results of the review and the actions taken to remedy any findings to be appropriately documented.

- Discretionary pension benefits – it is proposed that firms would be required to: (a) ensure that all discretionary pension benefits awarded to MRTs are in line with the business strategy, objectives, values and long‑term interests of the firm; (b) pay them only in shares or other permitted instruments; and (c) apply malus and clawback to discretionary pension benefits in the same way as to other elements of variable remuneration.

- Non-compliance – it is proposed that firms should take all reasonable steps to ensure that MRTs do not transfer the downside risks of variable remuneration to another party by using personal hedging strategies or remuneration‑ and liability‑related insurance. The guidance proposes that, for example, a firm might request an undertaking to this effect from its MRTs and implement dealing policies. It is also proposed that firms will be required to ensure variable remuneration is not paid through vehicles or methods that facilitate non‑compliance with the remuneration rules or the MIFIDPRU sourcebook. The consultation paper also emphasises that the FCA would expect all firms to comply not only with the letter but also the spirit of the proposed remuneration rules.

Extended remuneration requirements – applies to the largest non-SNI firms

The ‘extended remuneration requirements’ that apply to the largest non-SNI firms that exceed the financial thresholds summarised above are summarised here:

- Pay-out in instruments – it is proposed that firms will be required to pay at least 50% of an MRT’s variable remuneration in shares or certain other permitted instruments, including share-linked instruments and non-cash instruments that reflect the instruments of the portfolios managed. There are also proposals for firms that do not issue any of the types of permitted instruments to be able to apply to the FCA for a modification of the rules to allow alternative arrangements to be used instead to satisfy the pay-out requirements. The consultation paper sets out further detail on the permitted instruments.

- Deferral – it is proposed that firms must ensure: (a) at least 40% of the variable remuneration awarded to an MRT is deferred for at least 3 years; (b) where the variable remuneration is a particularly high amount, and in any case where it is £500,000 or more, at least 60% is deferred; and (c) the deferred variable remuneration does not vest faster than on a pro rata basis with the first deferred portion not vesting sooner than a year after the start of the deferral period. It is also proposed that firms will be required to pay out at least 50% of the deferred portion of the variable remuneration in shares and other permitted instruments. The proposals contain rules and guidance which set out the criteria that the FCA considers it may be useful for firms to consider when deciding how to structure the deferral schedule, as well as guidance on good practice relating to the composition of the deferred portion of variable remuneration.

- Interest and dividends – any interest and dividends paid on shares or other permitted instruments during a deferral period are received and owned by the firm. It is proposed that such interest or dividends must not be paid to the MRT either during or after the deferral period.

- Retention – it is proposed that firms must ensure that all shares and other permitted instruments issued for variable remuneration are subject to an appropriate retention policy. This means that they cannot be sold or accessed by the MRT for an appropriate period of time after the date on which they vest. The appropriate retention depends on a number of factors and the FCA has proposed guidance that firms should consider. The FCA has not, however, specified a specific retention period that should be applied by all impacted firms.

- Discretionary pension benefits – in addition to the requirements on discretionary pension benefits noted above, it is proposed that: (a) where an MRT leaves the firm before retirement age, the firm must hold the pension benefits for 5 years in the form of shares or other permitted instruments; or (b) where an MRT leaves the firm upon reaching retirement age, the firm must pay out the pension benefits in shares or other permitted instruments to be retained by the MRT for 5 years.

- Remuneration committees – it is proposed that a firm must establish a remuneration committee. The committee would be established at an individual entity level but firms may apply to the FCA for a modification to allow a remuneration committee to be established at group level instead where certain conditions are satisfied, one of which is that the firm considers that setting up the committee at an individual entity level would be unduly burdensome. These requirements would replace the current requirement for ‘significant IFPRU firms’ to establish a remuneration committee. Other non-SNI firms that fall outside of this scope are encouraged to consider whether establishing a remuneration committee might benefit their internal governance. The proposals also set out details on the composition and role of a remuneration committee required under the rules, including that, where the legal structure of a firm permits the firm to have non-executive members of their management body, at least 50% of the members of the remuneration committee must be non-executive members of the management body, including the committee chair. A firm categorised as an ‘Enhanced firm’ under the FCA’s Senior Managers & Certification Regime, and that will need to implement a remuneration committee for the first time under these proposals, should note that the chair of that remuneration committee will occupy a senior management function (SMF12) and will need to be approved by the FCA accordingly.

Next steps

The FCA is seeking feedback on this consultation by 28 May 2021. If you would like to respond to this consultation, you can do so by following the relevant instructions that can be found here. Once the FCA has received feedback on this paper, it appears that the FCA intends to publish a policy statement in the summer that will set out the near-final version of the remuneration rules. The final rules will be published once all of the IFPR consultations are completed and the UK Financial Services Bill has passed through the UK Parliament. It is proposed that the MIFIDPRU Remuneration Code would enter into force on 1 January 2022. A firm would need to apply the new rules from the start of its first performance year that begins on or after 1 January 2022. Firms currently in scope of the IFPRU or BIPRU Remuneration Codes would continue to apply those rules until 1 January 2022, or the beginning of their next performance year after that date, whichever is later.

Tapestry comment

Firms (and this lawyer) have been eagerly awaiting the publication of the proposed IFPR remuneration rules for some time and I expect that many firms will be generally happy with the proposals set out in the consultation paper. I dare say that there were no major surprises against what we had been expecting following the FCA’s discussion paper that was published back in June 2020. For a number of firms, including many firms that are currently in the scope of the IFPRU or BIPRU Remuneration Code, the proportionate approach that has guided the proposals will mean that those firms will transition to less detailed and more principles-based requirements. This will give those firms greater discretion as to how their remuneration is structured.

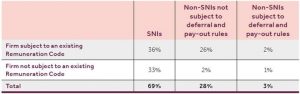

The proportionate regime will mean that certain structural requirements, such as those requiring deferral and payment in instruments, will only apply to a very small percentage of firms, as shown in the following table:

The proposed regime, although generally more flexible than existing requirements, also contains useful guidance that will likely help firms to understand the FCA’s expectations in relation to a variety of topics. The guidance builds on familiar themes found in the FCA’s existing rules and guidelines but also provides new guidance on topics that were not previously addressed, as well as providing more specific guidance on some topics. For example, the new guidance that clarifies that a buy-out award could follow the same deferral and vesting schedule as the bought-out award is a helpful addition that just reflects general market practice. It is also notable that the FCA did not choose to replicate existing guidance relating to the length of a post-vesting retention period, instead leaving it to firms to decide on the appropriate retention period.

The FCA has, however, left the door open for further rules and guidance on topics such as remuneration committee diversity, given that, unlike under the IFD, there are no proposed rules relating to having a ‘gender balanced’ remuneration committee. The FCA has also not currently included any detailed guidance on the requirement for firms to set an ‘appropriate ratio’ between fixed and variable remuneration, despite some general uncertainty within firms as to how these ratios should be determined and what purpose they will actually serve in practice. We may see further rules or guidance following the consultation process or at a later date and, for a few topics, the FCA has explicitly mentioned that those topics will be considered further.

The proposal document is extensive and detailed (and has resulted in probably the longest newsletter I will ever write) but I would encourage reward and regulatory compliance professionals to take the time to work through the proposals in connection with the broader compliance function. Although the proposed regime is likely to be generally well received (as far as any change in remuneration regulations can be!), there will still be topics that may cause issues for firm in practice. For example, I expect that the requirement for certain firms to establish a remuneration committee on a local basis except where a modification is granted by the FCA will, for a small number of firms impacted, raise a number of practical issues. We have seen that the FCA has been receptive to constructive and considered feedback in the past and so firms are encouraged to participate in the consultation process, either directly or through an industry body, to ensure that the positive aspects are retained and the negative aspects are removed or amended. Firms have until 28 May 2021 to respond and a response can be submitted on the consultation webpage that is linked in the ‘Next steps’ section above.

There is a lot of detail in the proposals and I would be happy to talk it through with you. If you have any questions or comments on this, please do let me know.

Matthew Hunter