17 July 2020

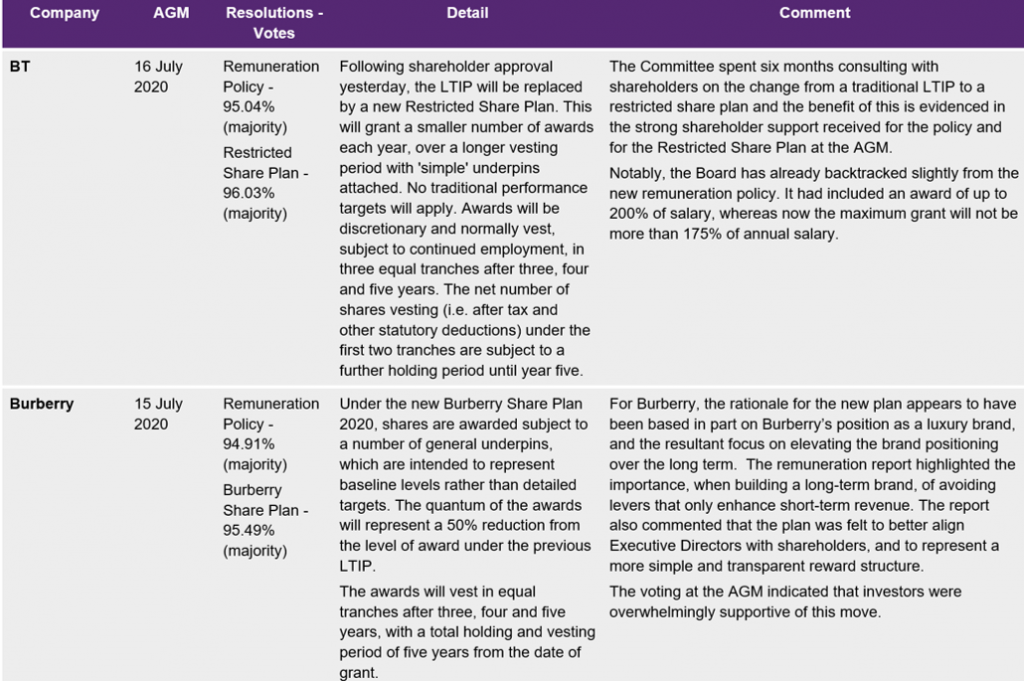

The consideration of restricted stock awards is gaining more momentum. These plans are relatively common below executive level and are now gaining more interest at board level. Notably, this week the shareholders of both BT and Burberry voted strongly in favour of restricted stock plans, which include executives, at their respective AGMs this week.

There has been support for alternative structures to common LTIP awards for some time now. In a COVID year, when investor pressures are forcing the consideration of total reward frameworks and it is increasingly difficult to set meaningful detailed performance conditions - will this be the year that more companies decide to use restricted stock?

Terminology

Firstly - let’s just think about what we mean by restricted stock. When you read the words “restricted stock” what does it mean to you? It’s important to know what award structure you are talking about. Different award types can have quite different treatments particularly from a legal and tax perspective.

For some the term restricted stock means upfront restricted shares - share ownership delivered on day one - subject to some restrictions perhaps on sale. Others would interpret these words to refer to forfeitable shares - share ownership again delivered on day one - perhaps subject to restrictions but also forfeitable. Meaning that the shares may be lost all together in certain circumstances - e.g. if performance targets are not met, or the employee leaves the company. More recently this term is used to refer to free share awards, that vest over a three-year (or longer) period, but that do not have complex performance targets. Instead, they have one or more general underpins such as company performance or shareholder returns’.

It is this latter award type that we are considering today, a conditional award, where ownership is not transferred until the vesting date and vesting is dependent on general underpins. You may also see the terms deferred shares and performance on grant awards being used (more on this below).

Background

In October 2019 the Purposeful Company produced a report on the use of deferred shares. The key findings report can be found here. The report provided widespread support for alternatives to LTIP structures. The report criticised LTIPs for being complex, allowing large pay-outs, and allowing pay-outs not necessarily linked to overall company performance. The report instead provides support for deferred shares to be held over the long term. Which they propose will create simplicity - with less time spent on executive pay and target setting. As well as higher levels of share ownership at CEO level which they believe will lead to higher long-term share price performance.

The report uses the term deferred shares to refer to any replacement of an LTIP that involves the award of long-dated share awards, including restricted stock, performance on grant plans and deferred bonuses. We have included the detailed definitions of these below.

The Investment Association’s Principles of Remuneration released in November 2019 - also gave some support to the recommendations of the Purposeful Company report noting that shareholders will “consider alternative remuneration structures if aligned to the company strategy”.

However, some investors have expressed concern, with views that restricted stock models provide payment for mediocrity or failure.

Some companies have already taken these sorts of plans to shareholders - but as we can see from the votes, investor support is not totally there yet. We have summarised the AGM votes on restricted stock plans and investor commentary accessible here, however, you can see the analysis for BT and Burberry below.

Detailed definitions

These are the terms used in the purposeful company report:

- Deferred shares: restricted shares, deferred bonus, or performance on grant award.

- Restricted shares: an award of deferred shares without further performance conditions attached, other than possibly an underpin condition prior to vesting (see below). Typically, the value of shares awarded will be lower than for an LTIP. For example, an LTIP award with a maximum value of 200% of salary (if all performance conditions are met) might be replaced by restricted shares worth 100% of salary, vesting over a longer time period including holding beyond retirement.

- Performance-on-grant: an award of deferred shares, similar to restricted shares, but subject to a performance condition prior to grant, often over more than one year, giving rise to a greater expectation of variability in the award level. Because performance conditions still apply, the discount in maximum value will be less than for restricted shares. For example, an LTIP award with a maximum value of 200% of salary (if all performance conditions are met) might be replaced by an award of deferred shares that could be as high as 150% of salary, but might vary between 50% and 150% of salary (or even down to zero) based on performance conditions applying over one or more years prior to the award. Once awarded, the deferred shares operate in the same way as for restricted shares.

Tapestry comment

In a year when it has been difficult to set meaningful detailed LTIP performance conditions I expect we will continue to see more interest in these “restricted stock” structures. However, whilst there seems to be some support, as we have seen there is not consistent widespread support amongst investors yet. Particularly where they do not feel the new restricted stock award has appropriate terms including the underpin, the vesting schedule and of most controversy - the discount level.

Whether more companies are able to demonstrate that revised structures are aligned to strategy and secure investor support is unclear. Companies exploring an alternative structure to an LTIP this year, ready for next year, will need to make sure that they have considered how this aligns with the overall company strategy. How they will explain the award structure clearly to investors, particularly providing comfort on the discount level when compared to previous LTIPs and how it will not “pay for failure”. Some investors are asking for companies to consult as far as 6 months out - so ensure you plan ahead.

The strong support at the AGMs of both BT and Burberry this week, demonstrates that where a company consults early, links strategy to reward and agrees the discount and vesting schedule with investors – these plans do get approved.

As the title of the article says - it’s all in the detail! Do not assume you know how an award operates from its title - ask the right questions and read the detail. When will ownership be delivered? When does the individual receive voting or dividend rights? Are there any restrictions or terms of forfeiture? What are the conditions of the award vesting? This will all impact the legal and tax implications of an award. Ensure that these details are explained clearly to investors so that they understand what is being proposed.

Restricted stock is one of the topics we are covering in our FTSE 100 review this year (as well as discretion, post-employment holding periods and ESG targets).

Carla Walsham & Sarah Bruce