15 March 2023

The UK’s Prudential Regulation Authority (PRA) has published a consultation paper proposing changes which would apply more proportionate remuneration rules and expectations to small CRR firms and small third-country CRR firms (together, ‘small firms’). The proposed changes will impact: (a) which remuneration rules small firms will have to apply; and (b) which firms qualify as a small firm.

These proposals are relevant to PRA-regulated banks, building societies and PRA-designated investment firms, including third-country branches which are subject to the Remuneration Part of the PRA Rulebook. The deadline for consultation responses is 30 May 2023.

Background

As a consequence of the latest iteration of the EU’s Capital Requirements Directive (CRD V) which took effect in 2020 when the UK remained subject to EU law, the PRA was required to change the conditions which were used to determine the remuneration rules that applied to certain firms, including a reduction in the financial thresholds.

The firms that meet the new conditions, being small firms, are currently not subject to some requirements, such as deferral and payment in instruments requirements, but are subject to other requirements, including malus, clawback, buyout and bonus cap requirements. Prior to these changes, these firms would not have been subject to malus, clawback or bonus cap requirements.

The PRA has received feedback and seen increasing evidence that these additional remuneration requirements have been ‘costly or burdensome’ for small firms and, as we are now in the post-Brexit world, they are reviewing the rules to create a more proportionate remuneration regime. As we have reported on separately, the PRA and the UK Financial Conduct Authority have already separately issued a consultation paper on the removal of the bonus cap.

Proposals

- Broader definition of a small firm. The conditions that are used to determine which firms qualify as small firms will be loosened, with the intention that more firms will meet the conditions. The aim is to align the conditions with the proposed criteria in the recent Simpler-regime consultation, where possible, although more firms will qualify as small firms under the amended remuneration rules than under the Simpler-regime.

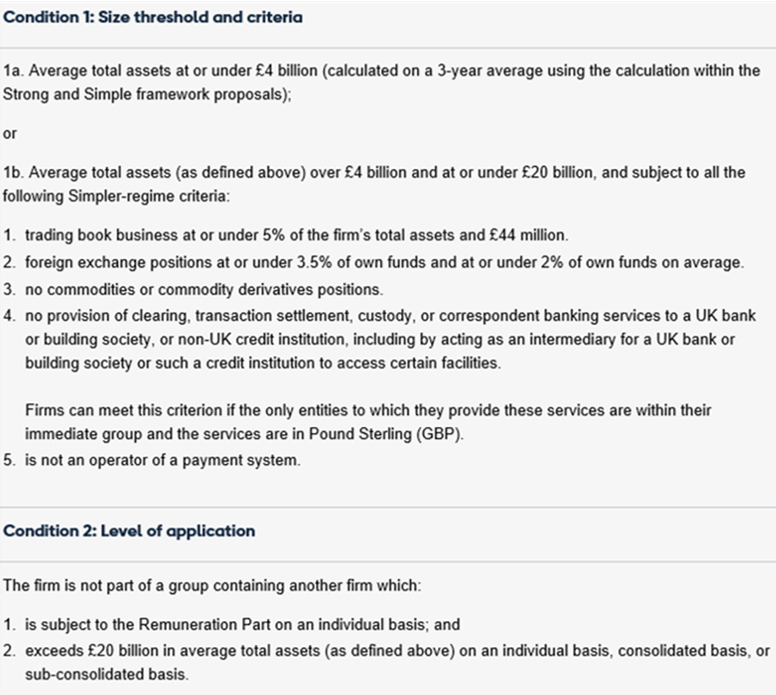

To benefit from the small firm remuneration regime, UK banks, building societies and UK designated investment firms will need to meet the following conditions: (a) either conditions 1a or 1b, as set out below; and (b) condition 2, as set out below:

The consultation paper provides further detail as to how third country CRR firms would apply the conditions which take into consideration the status of such entities as branches of overseas firms.

2. Fewer remuneration rules that apply to a small firm. Any firm that qualifies as a ‘small firm’ under the new definition will no longer be required to apply the rules on malus, clawback and buyouts. As noted above, there is a separate consultation in process in relation to the removal of the bonus cap.

3. New disclosure obligations. Small firms will be subject to a new expectation to disclose any material changes to their remuneration structures to their supervisors, especially on: (a) the ratio of the maximum payout of bonus and executive incentive schemes when compared to fixed remuneration; and (b) the performance measures and the risk adjustment used to determine whether and how much their bonus schemes and executive incentive schemes will pay out.

The PRA has also proposed to remove certain disclosure expectations from its guidance and has indicated that they intend to consult on their approach to remuneration disclosure requirements in the near future.

4. Timing. The proposed changes would come into force on the next calendar day after the publication of the final policy, which is anticipated for Q4 2023, and would apply to firms’ performance years starting after that. For most firms, this would likely be performance years starting in 2024.

Next steps

The proposed changes are subject to consultation and so the final policy changes may differ to those set out in the consultation paper. The consultation closes on 30 May 2023. Comments or enquiries should be sent to CP5_23@bankofengland.co.uk or to: Governance, Remuneration and Controls Policy Team, Prudential Policy Directorate, Prudential Regulation Authority, 20 Moorgate, London EC2R 6DA.

Tapestry comment

The proposals set out in this consultation paper, coupled with the existing consultation on the removal of the bonus cap, show the PRA’s willingness to scale back some of the more unpopular remuneration rules where it is proportionate to do so. There is also an indication that remuneration disclosure requirements will be reviewed. A more proportionate remuneration regulation regime will likely be welcomed by many firms.

The PRA states that a simpler prudential regime would facilitate effective competition, thereby supporting its existing secondary competition objective. The PRA also notably states that these proposals will facilitate compliance with the new secondary objective that the PRA will become subject to under the proposed Financial Services and Markets Bill 2022-23, which, at a high-level, will require the PRA to act in a way that facilitates: (a) the international competitiveness of the economy of the UK; and (b) its growth in the medium to long term.

The PRA considers that these proposals would facilitate competitiveness and growth as they would support the attractiveness of the UK as a place to do business by reducing the regulatory burden on firms. The more proportionate approach may also facilitate growth by reducing ongoing implementation costs and the greater flexibility offered to small firms in how they design their remuneration structures may also support them in their competition for talent with businesses within and outside of the UK, and within and outside of financial services (e.g. with technology firms).

It is important for firms to remember, however, that these proposals do not remove all of the remuneration requirements for impacted firms and firms will still be required to ensure that a prudent approach is taken to aligning risk and reward. The PRA considers that risks to safety and soundness for the proposed firms in scope can be mitigated sufficiently by other remuneration rules that the PRA is not proposing to modify.

It should be noted, however, that the recent shock to the financial services industry globally, triggered by the collapse of Silicon Valley Bank in the US, may lead the PRA and other policy makers to reassess whether now is a sensible time to be loosening remuneration regulations. We will have to wait and see if there is any change in direction.

Firms should assess if and how they will be impacted by the proposed changes and consider whether to respond to the consultation process.

Please do let us know if you have any questions or comments on this, or if we can assist you with your remuneration regulation compliance.

Matthew Hunter & Becky Moore