24 May 2023

The UK’s Financial Conduct Authority (FCA) has published a consultation paper proposing changes which would apply more proportionate remuneration rules to certain firms subject to the FCA’s Dual-regulated firms Remuneration Code. The proposed changes cover: (a) the criteria for determining when a firm may benefit from more proportionate and less restrictive remuneration requirements; (b) the removal of malus and clawback for those firms; (c) other minor changes to the FCA’s Handbook to address some differences between the FCA’s Handbook and the Prudential Regulation Authority’s (PRA) Rulebook; and (d) consequential changes to FCA’s non-Handbook guidance.

These proposals are relevant to credit institutions (banks and building societies), PRA designated investment firms and firms from overseas that carry on activities from an establishment in the UK that mean they would be a credit institution or designated investment firm if they were a UK domestic firm. The deadline for consultation responses is 9 June 2023.

Background

As a consequence of the latest iteration of the EU’s Capital Requirements Directive (CRD V) which took effect in 2020, when the UK remained subject to EU law, the FCA was required to change the criteria which were used to determine the remuneration rules that applied to certain firms, including a reduction in the financial thresholds.

The firms that meet the new criteria are currently not subject to some requirements, such as deferral and payment in instruments requirements, but are subject to other requirements, including malus, clawback and bonus cap requirements. Prior to the CRD V changes, these requirements did not apply to such firms.

The FCA has seen evidence that these additional remuneration requirements have been burdensome for small firms and they are reviewing the rules to create a more proportionate remuneration regime. As we have reported on separately: (a) the PRA has also issued a consultation on the remuneration regime for small firms; and (b) the PRA and the FCA have issued a consultation paper on the removal of the bonus cap.

Proposals

1. Proportionality criteria. The criteria that are used to determine which firms can disapply certain remuneration requirements will be loosened, with the intention that more firms will meet the criteria. The proposals align with those set out in the related PRA consultation.

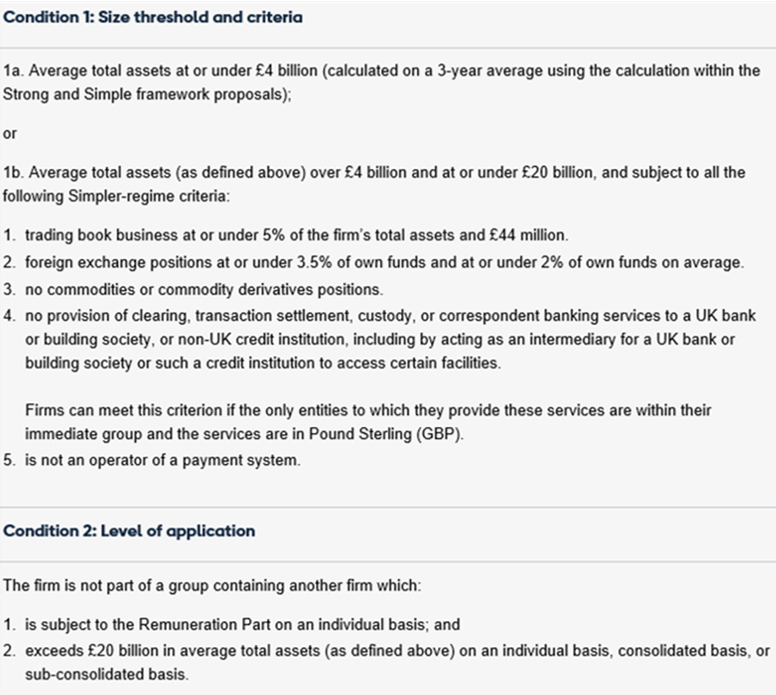

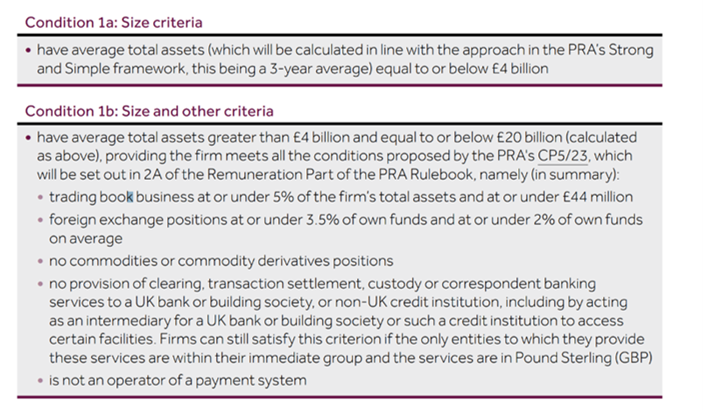

Under the proposals, a UK bank, building society or UK designated investment firm needs to meet either condition 1a or 1b set out below to be exempt from certain remuneration rules (e.g. deferral and payment in instruments requirements). The criteria outlined in 1b will cross-refer directly to the corresponding wording set out in the PRA Rulebook to ensure consistency in the future.

Where the firm is part of a group containing another firm subject to the FCA’s Dual-regulated firms Remuneration Code on an individual basis, both firms must meet the criteria on an individual basis, consolidated basis and sub-consolidated basis. This means that there cannot be a group where one firm benefits from the proportionality-based exemptions and another does not; all dual-regulated firms within a group must be subject to the same remuneration rules. The consultation paper also provides detail on how overseas firms would apply the criteria.

2. Removal of malus and clawback requirements for small firms. Firms that meet the amended proportionality criteria set out above will no longer be required to apply the rules on malus and clawback. The proposals align with those set out in the related PRA consultation.

3. Alignment with the PRA Rulebook. The FCA’s Dual-regulated firms Remuneration Code will be amended to align with the PRA’s Rulebook. The most substantive change will be to align the FCA’s approach to the identification of material risk takers with the PRA’s approach by cross-referring directly to wording set out in the PRA Rulebook, although there are other minor wording changes to align the rules in the FCA Handbook with their equivalent in the PRA Rulebook.

4. Updated non-Handbook guidance. Consequential amendments will be made to the FCA’s non-Handbook guidance to reflect the changes outlined above. The specific guidance that will be amended is set out in the consultation paper.

The impacted guidance includes guidance on proportionality, FAQs on remuneration for dual-regulated firms (including guidance in relation to who can be excluded as a material risk taker) and the FCA’s general guidance on the application of ex-post risk adjustment to variable remuneration, which will, in particular, clarify that dual-regulated firms must ensure that variable remuneration is only awarded on the basis of risk-adjusted performance set in a multi-year framework. This means that all firms should continue to consider, and make adjustments to, in-year variable remuneration at firm, business unit and / or individual level to reflect ex-post risk.

5. Timing. The proposed changes on the proportionality criteria and on the removal of malus and clawback for impacted firms would come into force on the next calendar day after the publication of the final policy statement, which is anticipated for Q4 2023, and would apply to firms’ performance years starting after that. The FCA and PRA intend to align the timing of the final rules and guidance. The proposed changes to ensure alignment with the PRA Rulebook will come into force and apply immediately following the publication of the final policy statement.

Next steps

The proposed changes are subject to consultation and so the final policy changes may differ to those set out in the consultation paper. The consultation closes on 9 June 2023. Comments or enquiries should be sent to cp23-11@fca.org.uk, using the form on the FCA’s website or to: Governance & Cross-Cutting Standards team, Financial Conduct Authority, 12 Endeavour Square, London E20 1JN. If a firm has already responded to the PRA’s consultation, firms can respond to the FCA’s consultation by sharing that response with the FCA.

Tapestry comment

The proposals set out in this consultation paper are broadly consistent with the PRA's proposed changes in its consultation paper on enhancing proportionality for small firms and similarly aim to provide increased flexibility for dual-regulated firms that meet the new, less restrictive criteria. The new criteria, and the removal of malus and clawback requirements for impacted firms, seek to ensure that the remuneration framework is more proportionate for smaller and less complex firms and will be welcomed by those firms.

The proposals to more closely align the FCA Handbook to the PRA Rulebook, particularly in relation to material risk taker identification, will also be welcomed as it will help to reduce some of the unnecessary complexity that was created by having overlapping (yet sometimes misaligned) FCA and PRA rules applying to the same firms and staff members.

It is anticipated that these changes will go ahead as consulted upon, with the proportionality changes taking effect for the first performance year starting on or after the final policy statement is published, which is anticipated for Q4 2023. It should be noted that the proposed removal of the bonus cap would also take effect around this time. Firms should consider whether they will be impacted by the new, less restrictive proportionality criteria and, if so, consider how and when the changes will be reflected in the firm’s remuneration structures. For firms that will be able to benefit from the new proportionality criteria, it may be that material risk takers may no longer be subject to, in particular, deferral, payment in instruments, malus, clawback or bonus cap requirements.

Please do let us know if you have any questions or comments on this, or if we can assist you with your remuneration regulation compliance.

Matthew Hunter & Lewis Dulley

USA - SEC adopts rules on clawback

USA - SEC adopts rules on clawback