8 March 2023

Registrations for this year's Certificate in Employee Share Plans course, accredited by the CGIUKI, will be closing very soon! Book now before it's too late!

For the details about the 2023 course and details on how to register, please see below.

How will the course be structured?

The course is split into 2 parts and each part will be taught over 5 short days on Zoom, finishing around lunchtime each day. These session timings make it easier and more practical for on-screen learning and to fit around other commitments.

The course will combine larger group teaching with participatory learning through smaller breakout sessions, each hosted by a Tapestry lawyer. These sessions ensure an interactive experience and the opportunity to learn from each other, with fun exercises and practical examples to help consolidate your knowledge.

Are there in-person networking opportunities?

Yes. One of the most valuable added benefits of the course is the networking opportunities that you get from being with your classmates outside of the office. So although the teaching will be virtual, we will be hosting optional in-person networking sessions in London. Drinks are on us!

How will the course be examined?

Exams will be held virtually for the 2023 course. The examination dates are set out below.

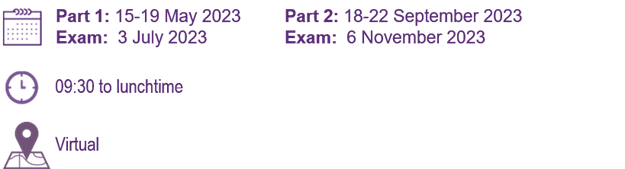

What are the dates for the course?

Each part of the course will run over 5 short days. Times below are UK times.

Part 1: 15 - 29 May 2023

Exam: 3 July 2023

Part 2: 18-22 September 2023

Exam: 6 November 2023

Teaching: 9.30 to lunchtime

Exams: 13.30 onwards

Do I need to book time off work to attend the course?

Course participants should plan to attend the course teaching in an uninterrupted virtual learning environment. We know this can be challenging at times, however we do find a strong connection between active course participation and exam success. We therefore recommend that you and your employer treat the time you are attending the tuition (i.e until around lunchtime each day) as being ‘out of the office’, just like you would if the course was in-person. There is time to work in the afternoons, if needed.

Note that you should plan to attend all of the course tuition (and minimum attendance requirements apply). Course participants will also need to commit to self-study time to prepare for the exams.

How much will the course cost?

Our 2023 course price is £4,250 plus VAT.

How do I confirm my place?

We very much hope that you are able to join us – please click ‘Register here’ to book your place. Please indicate when making your booking if you are based in the UK or overseas.

What our 2022 course participants say...

“The course provides practical and helpful information on a range of share plan topics and is taught in a simple to understand way.”

Alex Pollard, Caledonia Investments plc

“Really well presented course with excellent speakers, course notes and guidance. I found it really useful and am glad to have done it. Can’t recommend it enough.”

Elle Solomi

“Fantastic course, great speakers and support! Fully recommend to help on your Employee Share Plans journey.”

Iqbal Grewal, Computershare

“Helped me in my day job and also gives me a better understanding of other areas and departments of the business.”

Jonny Thompson, Link Group

If you have any queries regarding the course, please do contact us. More information can also be found on our course website.

Best wishes

Team Tapestry

Australia - employee share scheme reforms tweaked

Australia - employee share scheme reforms tweaked Canada - trust reporting delayed - again

Canada - trust reporting delayed - again India - new foreign exchange rules

India - new foreign exchange rules Russia - update on the impact of counter-sanctions regime

Russia - update on the impact of counter-sanctions regime  USA - SEC adopts rules on clawback

USA - SEC adopts rules on clawback  Global tax rates

Global tax rates