6 October 2022

We are delighted to announce that registration is now open for Tapestry’s Certificate in Employee Share Plans 2023.

Following the positive feedback we received on both our 2021 and 2022 virtual courses, we are very pleased to confirm that the Certificate will be delivered virtually for 2023! The course will run with virtual interactive teaching sessions, so you can take the course wherever you are.

Similar to the 2022 course, we will continue to combine virtual learning with in-person networking events - so the class of 2023 will get the best of both worlds.

Whether you want to learn about plan design, or how to develop and operate share plans effectively and compliantly, our industry leading experts will give you the knowledge to find the solutions you need. The course will be delivered in a flexible way, whilst maintaining all the great aspects we know our attendees value.

Completing the course continues to result in an accreditation by the Chartered Governance Institute UK & Ireland.

What does the course cover?

Tapestry’s Certificate in Employee Share Plans is a must have for anyone who works with executive or employee share plans. This course will help you gain specialist knowledge in:

- plan design

- accounting principles

- legal requirements

- disclosure & reporting

- tax

- compliance

The course is suitable for anyone working with employee share plans, including HR, in-house legal, reward or other compensation professionals, those working in company secretariat, and external administrators, reward (or other non-legal share plan) professionals and benefits consultants.

How will the course be structured?

The course is split into 2 parts and each part will be taught over 5 short days on Zoom, finishing around lunchtime each day. These session timings make it easier and more practical for on-screen learning and to fit around other commitments.

The course will combine larger group teaching with participatory learning through smaller breakout sessions, each hosted by a Tapestry lawyer. These sessions ensure an interactive experience and the opportunity to learn from each other, with fun exercises and practical examples to help consolidate your knowledge.

Are there in-person networking opportunities?

Yes. One of the most valuable added benefits of the course is the networking opportunities that you get from being with your classmates outside of the office. So, although the teaching will be virtual, we will be hosting optional in-person networking sessions in London. Dinner and drinks are on us!

How will the course be examined?

Exams will be held virtually for the 2023 course. The examination dates are set out below.

What are the dates for the course?

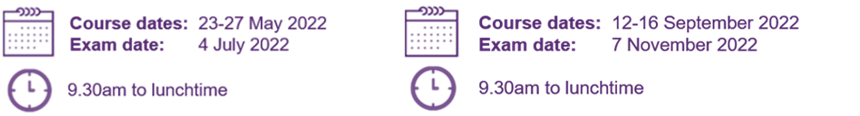

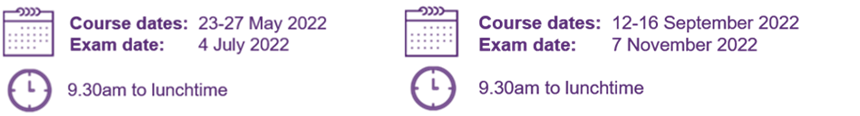

Each part of the course will run over five short days. Times below are UK times.

Time: 09.30 to lunchtime

Part 1: 15-19 May 2023 Part 2: 18-22 September 2023

Exam: 3 July 2023 Exam: 6 November 2023

Do I need to book time off work to attend the course?

Course participants should plan to attend the course teaching in an uninterrupted virtual learning environment. We know this can be challenging at times, however, we do find a strong connection between active course participation and exam success. We therefore recommend you and your employer treat the time you are attending the tuition (i.e. until around lunch time each day) as being ‘out of the office’, just like you would if the course was in-person. There is time to work in the afternoons if needed, though.

Note that you should plan to attend all of the course tuition (and minimum attendance requirements apply). Course participants will also need to commit to self-study time to prepare for the exams.

How much will the course cost?

Our 2023 course price is £4,250 plus VAT.

Register and pay by 31 December 2022 to get our Early Bird rate of £3,950 plus VAT.

To register or if you have any queries, please contact us

What our 2022 course participants say...

"Blown away by the exceptional quality of the Tapestry team, delivery of the course and the materials. Well done!"

Louise Poulter, BP

"It is a must-do course for everyone involved in share related activities."

Hanna Oszczeda, Unilever

"Excellent content, delivered at a steady pace and explained really well. A great course for both those with some experience and those new to the area."

Steve Vanston, HWC

"An extremely valuable and informative course, delivered by experienced and knowledgeable people in a clear and concise way."

Elliot Alexander, Computershare

If you have any queries regarding the course, please do contact us. More information can also be found on our course website.

Best wishes

Team Tapestry

Australia - securities law reforms due to take effect

Australia - securities law reforms due to take effect

Ireland - Employee tax compliance notification

Ireland - Employee tax compliance notification Poland - not another securities filing!

Poland - not another securities filing! Russia - new cross-border data transfer rules

Russia - new cross-border data transfer rules UK

UK Global tax rates

Global tax rates Global tax and social security

Global tax and social security

Hannah Needle, FGE is a Legal Director and on the Board of Directors at Tapestry. Hannah leads on Tapestry’s legal services, and is therefore instrumental in the delivery, development and quality of the firm’s legal advice, both in the UK and globally.

Hannah Needle, FGE is a Legal Director and on the Board of Directors at Tapestry. Hannah leads on Tapestry’s legal services, and is therefore instrumental in the delivery, development and quality of the firm’s legal advice, both in the UK and globally.

Canada - termination provisions upheld

Canada - termination provisions upheld China - extends preferential tax treatment

China - extends preferential tax treatment Data Protection - global update

Data Protection - global update Global tax rates

Global tax rates Netherlands - change to taxable moment withdrawn

Netherlands - change to taxable moment withdrawn